Enhance Your Heritage With Expert Depend On Structure Solutions

Specialist trust fund structure remedies supply a durable structure that can secure your possessions and guarantee your dreams are lugged out exactly as meant. As we dig into the nuances of trust foundation services, we discover the crucial components that can strengthen your heritage and supply a long-term effect for generations to come.

Benefits of Trust Structure Solutions

Count on structure options provide a durable structure for securing properties and making sure long-lasting financial safety and security for individuals and organizations alike. One of the main advantages of trust fund structure solutions is asset defense. By establishing a trust, individuals can secure their properties from potential dangers such as claims, creditors, or unanticipated financial obligations. This defense makes certain that the possessions held within the trust remain secure and can be passed on to future generations according to the person's dreams.

In addition, trust structure options offer a tactical method to estate planning. Via trusts, people can describe just how their properties need to be handled and distributed upon their passing away. This not just helps to stay clear of conflicts amongst beneficiaries yet also makes sure that the individual's heritage is preserved and took care of efficiently. Depends on additionally offer privacy benefits, as properties held within a trust are exempt to probate, which is a public and commonly prolonged legal process.

Sorts Of Depends On for Heritage Preparation

When thinking about tradition preparation, a vital facet includes exploring various kinds of legal tools made to maintain and disperse assets successfully. One common sort of trust fund used in tradition planning is a revocable living trust fund. This trust fund allows people to maintain control over their possessions during their lifetime while making certain a smooth change of these assets to recipients upon their passing away, staying clear of the probate procedure and providing personal privacy to the household.

One more kind is an unalterable count on, which can not be modified or withdrawed as soon as established. This trust supplies potential tax advantages and safeguards possessions from lenders. Philanthropic trust funds are also prominent for individuals aiming to support a cause while maintaining a stream of earnings on their own or their recipients. Special needs trust funds are vital for people with impairments to ensure they obtain necessary treatment and support without jeopardizing federal government benefits.

Recognizing the various kinds of depends on readily available for tradition planning is important in establishing a thorough method that aligns with individual goals and top priorities.

Choosing the Right Trustee

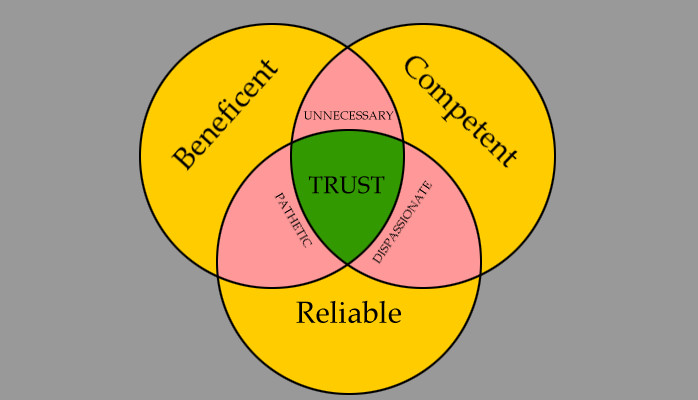

In the world of heritage preparation, a critical aspect that demands cautious factor to consider is the selection of a suitable person to satisfy the pivotal role of trustee. Selecting the right trustee is a decision that can significantly influence the successful execution of a depend on and the satisfaction of the grantor's wishes. When selecting a trustee, it is necessary to prioritize qualities such as credibility, financial acumen, honesty, and a dedication to acting in the most effective passions of the recipients.

Preferably, the chosen trustee ought to possess a solid understanding of economic issues, be capable of making audio financial investment choices, and have the capability to navigate complex lawful and tax obligation needs. By thoroughly taking into consideration these factors and choosing a trustee that aligns with the worths and goals of the count on, you can help make sure the long-lasting success and preservation of your heritage.

Tax Effects and Advantages

Thinking about the monetary landscape surrounding trust structures and estate planning, it is paramount to delve into the detailed realm of tax obligation ramifications and advantages - trust foundations. When developing a click resources trust, understanding the tax obligation effects is critical for optimizing the benefits and minimizing prospective liabilities. Trust funds use different tax obligation advantages relying on their framework and purpose, such as minimizing estate tax obligations, earnings taxes, and gift tax obligations

One substantial benefit of specific depend on structures is the ability to move assets to recipients with minimized tax obligation consequences. Unalterable depends on can get rid of properties from the grantor's estate, potentially decreasing estate tax responsibility. In addition, some trust funds permit for revenue to be dispersed to beneficiaries, who might remain in lower tax obligation brackets, causing overall tax obligation cost savings for the family members.

However, it is essential to note that tax obligation regulations are complicated and conditional, emphasizing the need of seeking advice from tax obligation professionals and estate preparation specialists to make sure compliance and make best use of the tax obligation advantages of trust structures. Properly browsing the tax effects of depends on can result in substantial savings and a much more reliable transfer of riches to future generations.

Actions to Establishing a Depend On

To develop a count on efficiently, meticulous interest to information and adherence to legal protocols are essential. The very first step in establishing a trust fund is to clearly specify the objective of the count on and the possessions that will certainly be included. This includes recognizing the beneficiaries who will certainly benefit from the trust and selecting a credible trustee to take care of the possessions. Next, it is important to select the kind of trust fund that finest aligns with your goals, whether it be a revocable count on, unalterable count on, or living depend on.

Verdict

Finally, establishing a trust structure can provide countless benefits for legacy planning, consisting of property security, control over distribution, and tax obligation advantages. By choosing the suitable type of depend on and trustee, people can safeguard their properties and ensure their dreams are executed according to their wishes. investigate this site Comprehending the tax effects and taking the needed steps to develop a depend on can help reinforce your tradition for future generations.